“Nothing astonishes men so much as common sense and plain dealing”

The extreme volatility that we witnessed in recent weeks continued to recede heading into last week’s Federal Reserve Bank Open Market Committee (FOMC) meeting. 1 I believe that as we slowly transition out of this “Goldilocks economy”, and the Fed begins raising interest rates, market volatility could remain at elevated levels.

The Fed's Conundrum

The market initially breathed a sigh of relief as the Fed maintained its accommodative policy on Thursday. According to FactSet's September 4 report, “The second quarter of 2015 marks the first time the index has seen two consecutive quarters of year-over-year revenue declines since Q2 2009 and Q3 2009. It also marks the largest year-over-year decline in revenues since Q3 2009 (-11.5%).”2 The report mentioned that only six sectors were reporting increases in revenue, led by healthcare.

Slowing global growth, along with the strong dollar, could continue to be a headwind to the earnings estimates. The S & P 500 is expected to earn about $128 based on September 4th closing price of 1951.3 according to FactSect Earnings Insight 9.4.15. In his September Insights piece, Rich Bernstein states: “The Fed now risks being wrong-footed, and the problem for the stock market today is the Fed is ‘threatening' to raise interest rates at a time when the S & P 500® earnings growth is actually negative.”4

A look at history: Fed rate hikes & market performance

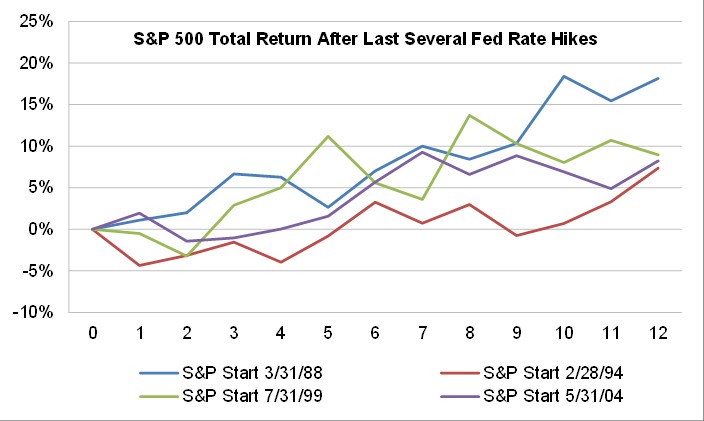

The chart below illustrates the return of the S & P 500 after the last four Fed rate hike cycles. In most cases, equities struggled after the first hike, only to recover and outperform in the ensuing year following the first rate increase. Click here for a quick lesson from Investopedia on, "How interest rates affect the stock market."

Source: Morningstar and FPS, Inc.

The markets have become addicted to QE and a zero interest rate policy (ZIRP). Getting rid of it will involve some withdrawal pain. According to a Congressional Budget Office (CBO) report released in January of this year, once the Fed begins raising rates, the 10-year Treasury note will begin rebounding to its historic norm and reach 4.6% by 2025. This return to normalization will raise our national debt payments from $227 billion a year in 2015 (1.3% of GDP) to over $820 billion by 2025 (3.0% of GDP, the highest ratio since 1996).3 So, one can imagine why the markets are obsessing over successive rate hikes. Future costs of servicing our national debt due to higher interest rates could present a real drag on GDP.

Expect lower interest rates for longer

The Fed's accommodative ZIRP has been a key driver behind the bull market we have enjoyed over the past several years. It’s not the first rate hike that's concerning the market, as it’s been talked about more than just about any other financial topic over the past few years. It's the speed and severity of successive hikes — markets want a slow and steady path back to normalized rates. Our view remains that it could take longer than expected for Treasury yields to normalize because of slow economic growth, low inflation, and robust demand for our 10-year and 30-year Treasury debt from home and abroad.

Footnotes:

1. Investopedia: VIX (CBOE Volatility Index). Definition. http://www.investopedia.com/terms/v/vi

2. Fact Set Earnings Insight, September 4, 2015.

3. Congressional Budget Office Report, "The Budget and Economic Outlook: 2015-2015" January 2015.

Observations and views expressed herein may be changed at any time without notice and are not intended as investment advice or to predict future performance. It is not an offer, recommendation or solicitation to buy or sell, nor is it an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable. Changes to assumptions may have a material impact on any returns detailed. Past performance is not an indication of future returns. Price and availability are subject to change without notice. Consult your financial professional before making an investment decision. Additional information is available upon request.